|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

2 High-Yield Dividend Stocks to Buy with Unshakeable Payouts

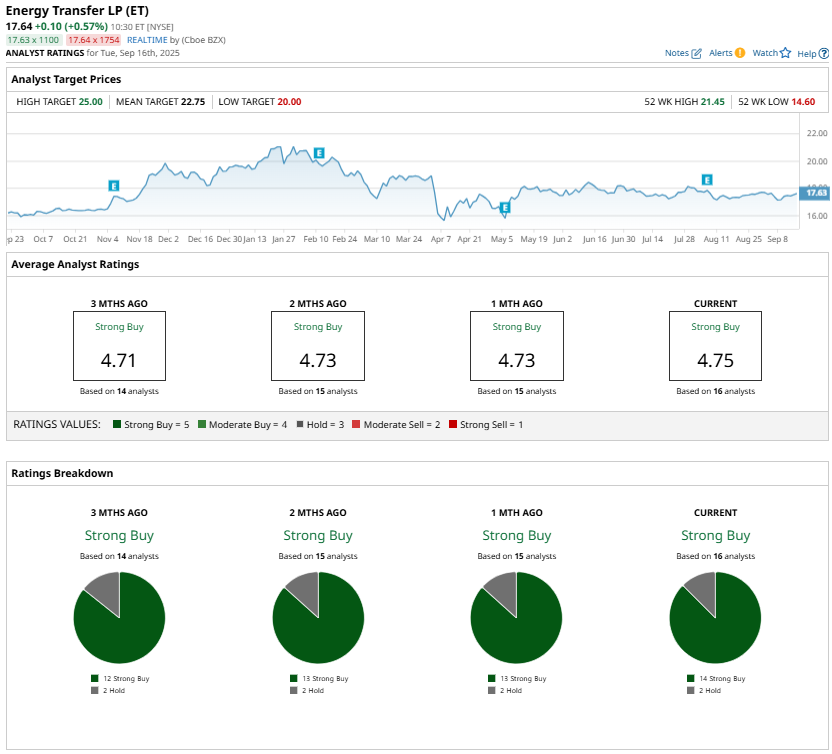

Dividend stocks are attractive options for generating income. While plenty of companies pay dividends, only a few keep paying you regardless of market conditions. The companies with resilient payouts are usually those with large businesses, a steady earnings base, and a focus on enhancing shareholder value. Among the most reliable dividend stocks, Energy Transfer (ET) and Realty Income (O) stand out for their high yields and ability to pay and increase their dividends. High-Yield Dividend Stock #1: Energy TransferEnergy Transfer is one of the most reliable high-yield dividend plays. This energy infrastructure company has an extensive intrastate pipeline network in the U.S., connecting major natural gas (NGX25) producers to utilities, power plants, industrial users, and third-party pipelines. Thanks to its extensive network, its assets play a significant role in transporting energy and witness a steady utilization rate. Energy Transfer’s long-term, fee-based contracts with high-quality counterparties add stability to its operations. Moreover, this operating structure reduces exposure to commodity price swings and enables it to generate predictable cash flows, supporting its payouts. Thanks to its reliable cash flows, Energy Transfer consistently pays and increases its dividend. It recently announced a 3% hike in its quarterly dividend to $0.33 per share, which translates into a high 7.5%. Energy Transfer continues to secure new long-term volume commitments, improve operational efficiencies, and invest in projects that promise durable returns. A $5 billion slate of organic growth initiatives is underway. Management anticipates mid-teen returns from these investments, with full earnings contributions ramping significantly into 2026 and 2027. These projects are contracted mainly with high-quality counterparties, adding visibility into future cash flows. Further, structural tailwinds in the natural gas market strengthen Energy Transfer’s outlook. The development of new gas-fired power plants and data centers, and rising industrial and onshore manufacturing activities, is likely to drive demand for its infrastructure, supporting its earnings and future dividend payments. In summary, its reliable fee-based earnings, a solid pipeline of growth projects, and commitment toward dividend growth make Energy Transfer a reliable income stock. Energy Transfer aims to grow its dividend by 3%–5% annually in the coming years. Analysts maintain a “Strong Buy” consensus, reflecting confidence in the company’s ability to maintain its high yield and steady dividend growth.

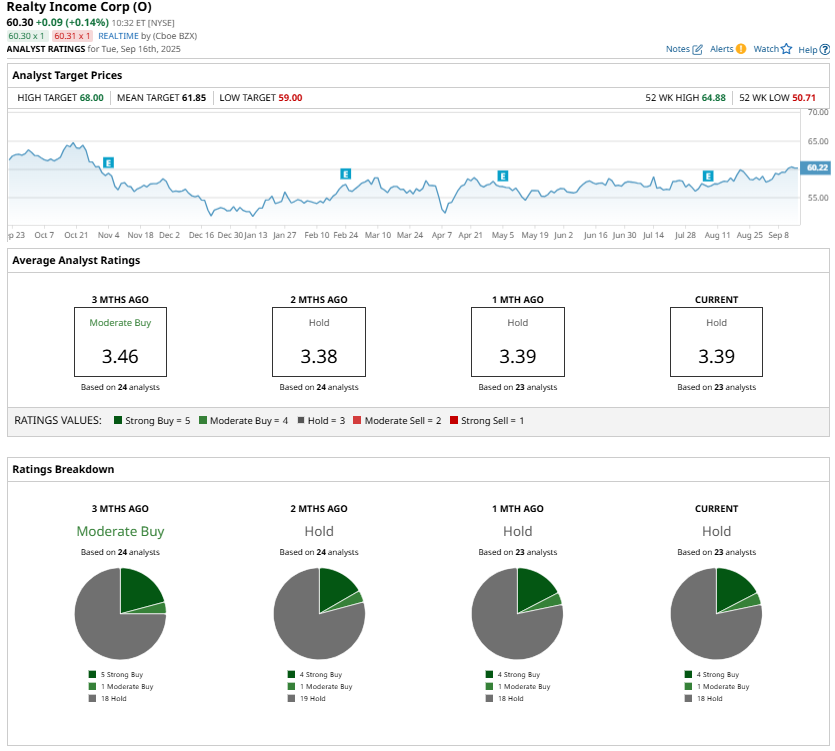

High-Yield Dividend Stock #2: Realty IncomeRealty Income is another high-yield dividend stock offering monthly payouts. The real estate investment trust (REIT) manages a diversified portfolio of over 15,606 commercial properties. By spreading its investments across various property types, tenants, and regions, the company has built a resilient business generating stable cash flows and supporting reliable dividends. Around 90% of its rental income is either recession-resistant or insulated from the challenges posed by e-commerce. About 97.9% of its properties are single-tenant, with leases structured to pass most property-related expenses on to tenants. This approach protects the company’s profit margins and ensures predictable, long-term cash flow. Thanks to its high-quality properties and solid rent collection rate, Realty Income has consistently paid and increased its dividend. It has declared 663 consecutive monthly dividends and is a part of the S&P 500 Dividend Aristocrats Index. Its dividend has grown at a compound annual growth rate (CAGR) of 4.2% since 1994, and it currently offers an attractive annualized yield of roughly 5.3%, making it an attractive income stock. The company’s conservative underwriting standards and strict tenant selection have kept credit losses at a negligible 0.4%, highlighting the strength of its portfolio. Its operational metrics remain impressive. The company closed its latest quarter with 98.6% occupancy and a strong rent recapture rate of 103.4%, including a 139% recapture on re-leases to new tenants. Looking ahead, Realty Income’s scale, diversified portfolio of resilient properties, and high occupancy rate position it to maintain and grow its monthly dividends. While analysts rate it a “Hold,” its high yield and reliable payout history make Realty Income a dependable income stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|