|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

What Are Wall Street Analysts' Target Price for Elevance Health Stock?/Elevance%20Health%20Inc%20laptop-by%20monticello%20via%20Shutterstock.jpg)

With a market cap of $71.3 billion, Elevance Health, Inc. (ELV) is an Indiana-based managed healthcare and insurance provider. Through brands like Anthem Blue Cross and Blue Shield, Carelon, and Wellpoint, the company offers a wide range of services including medical, behavioral health, pharmacy benefit management, dental, and long-term care. Shares of ELV have fallen behind the broader market. ELV stock has declined 41.7% over the past 52 weeks and has dipped 14.2% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 16.1% over the past year and declined 10% in 2025. Narrowing the focus, ELV has also lagged behind the Health Care Select Sector SPDR Fund’s (XLV) 10.7% fall over the past 52 weeks and a marginal rise on a YTD basis.

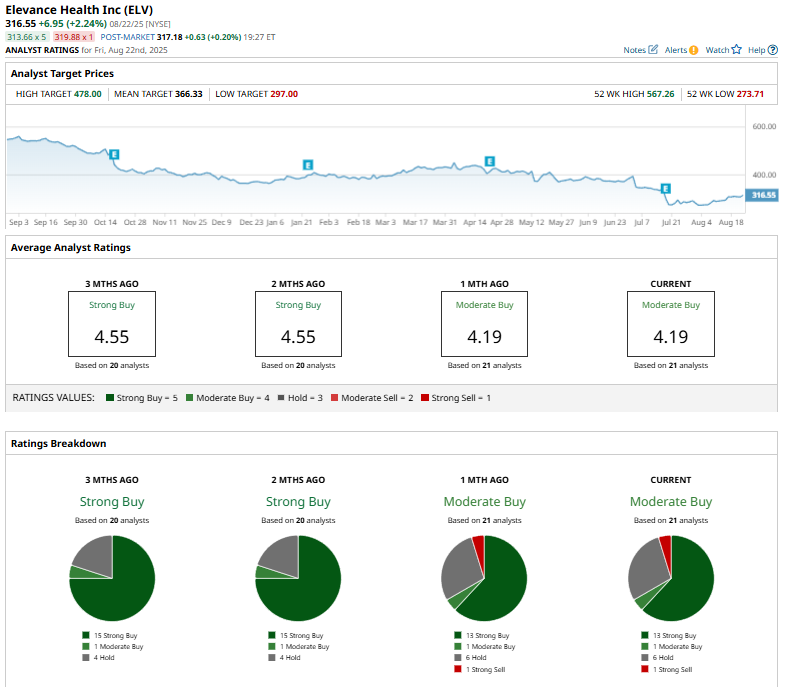

On Jul. 17, Elevance Health released its second-quarter earnings and its shares dipped 12.2%. It posted a revenue growth of 14% year over year to $49.4 billion but saw earnings pressured by rising ACA and Medicaid costs, with adjusted EPS dropping to $8.84 from $10.30 a year earlier and net income falling 24% to $1.74 billion. The company’s medical loss ratio worsened to 88.9%, though cost controls improved its operating expense ratio to 10% and boosted operating cash flow to $2.1 billion. For the current year ending in December, analysts expect ELV’s EPS to decline 9.6% year over year to $29.88. Moreover, the company has surpassed or met analysts’ consensus estimates in two of the past four quarters, while missing on two other occasions. Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” four “Holds,” and one “Strong Sell.”

The current overall consensus is bearish than two months ago when the stock had a “Strong Buy” rating. On Aug. 15, Wells Fargo analyst Stephen Baxter reiterated an “Overweight” rating on Elevance Health but lowered the price target from $400 to $330, reflecting a more cautious outlook despite maintaining a positive stance on the stock. ELV’s mean price target of $366.33 indicates a premium of 15.7% from the current market prices. Its Street-high target of $478 suggests a robust 51% upside potential from current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|