|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

Analysts Keep Raising ConocoPhillips Target Prices - Shorting Puts is a Good Play Here

ConocoPhillips' (COP) stock has risen since the Aug. 7 release of its Q2 results. Analysts have been upping their price targets. COP stock looks undervalued based on its historical yield. Shorting out-of-the-money puts is a good play. COP closed at $96.78 on Friday, Aug. 22, up 2%, but higher than the $92.60 closing price on Aug. 7. It could have a good way to go, as this article will show.

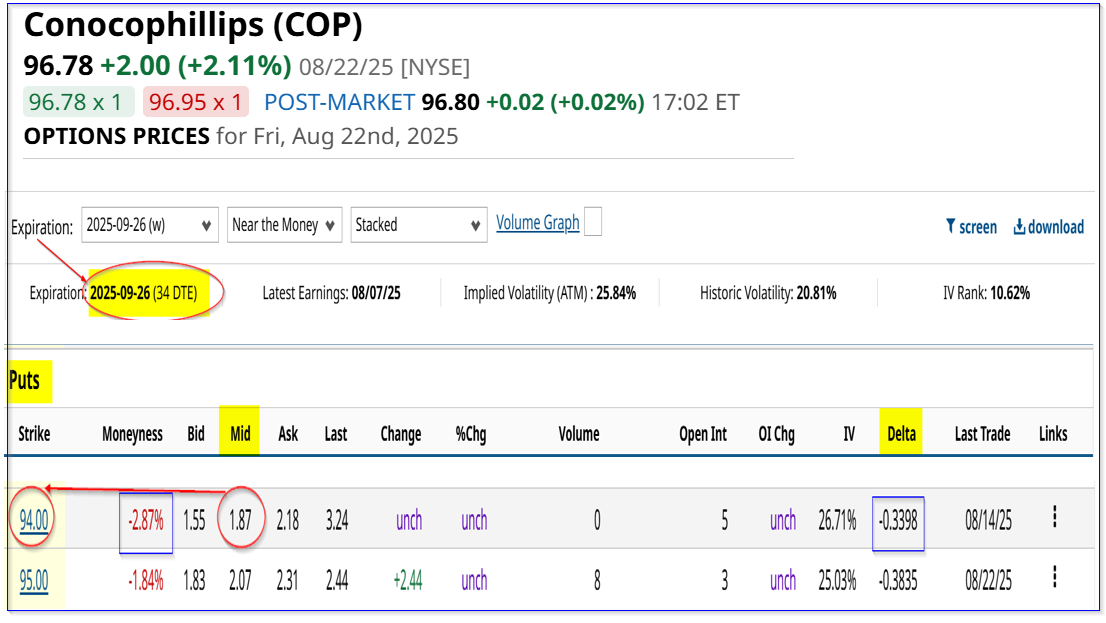

I discussed Conoco's value in an Aug. 8 Barchart article ("ConocoPhillips Produces Lower FCF and Investors are Bored - But is COP Stock Too Cheap?"). Target PricesI argued that based on its free cash flow and dividend yield, COP stock could be worth $116 per share. That still provides a potential upside of about +20% from today's opening price. Moreover, analysts have been raising their target prices. For example, Stock Analysis now reports that 17 analysts have an average price target of $121.06. That is up from $120.38 just three weeks ago, as seen in my Aug. 8 Barchart article. Similarly, AnaChart.com now reports that 21 analysts have an average price of $123.35, vs. $118.90 in my last article. The point is that COP stock still appears undervalued from several standpoints, including its historical yield average and analysts' targets. One way to play this, as I wrote last time, is to sell short out-of-the-money (OTM) puts. That way, an investor can make money while waiting to buy in at a lower price, potentially. Shorting Out-of-the-Money (OTM) COP PutsFor example, in my prior article, the $90.00 puts expiring in 4 weeks on Sept. 5 traded for a midpoint premium of $1.63. That has worked out well. Here's why. The strike price was 3.6% below the trading price, and the investor made a 1.811% yield (i.e., $1.63/90.00) immediately. Today, the put option premium has fallen to just 24 cents at the midpoint, since COP stock has risen. That means the investor has made most of the yield already, with just 2 weeks left. At this point, the option is likely to expire worthless, but the investor will make only 24 cents during that period. So, it makes sense to roll this play over to a later calendar date to pick up more yield. For example, look at the Sept. 26 expiry period, 33 days from now. It shows that the midpoint premium for the $94.00 put option strike price contract has a midpoint premium of $1.87.

That means an investor can make an immediate short-put yield of almost 2.0% (i.e., $1.87/$94.00 = 0.01989 = 1.989%) over the next month. Even after deducting the cost of rolling over the prior trade (i.e., a “Buy to Close” trade), the net yield is still high: $1.87 - $0.24 = $1.63, and $1.63/$94.00 = 1.734% That means that over the full six-week period from Aug. 8 to Sept. 26, an investor would have collected $326 (i.e., $163 x 2) for an average investment of $9,200 during that period: $326/$9,200 = 0.354 = 3.54% over 6 weeks That represents a potential annualized expected return (ER) of over 30%: 52 wks / 6 wks x 3.54% = 8.67 x 3.54% = 30.69% ER (This assumes that the same short-put yields could be made every 6 weeks with COP stock). Moreover, the breakeven price is now much lower: $92.00 average strike price - $3.26 = $88.74 breakeven price That means at the $121 target price, an investor could potentially make an upside of +36.35%. This assumes that COP falls first to the strike price and the account is assigned to buy 100 shares. The bottom line is that this is a very efficient way of getting paid by investing in out-of-the-money puts in COP stock for value investors. On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|