|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

Cathie Wood Is Buying Up This Blue-Chip Stock. Should You?

Cathie Wood, the founder and CEO of ARK Invest, is best known for chasing high-growth opportunities in disruptive technologies before they go mainstream. That’s exactly why her latest move stands out. Instead of doubling down on genomics, fintech, or artificial intelligence (AI) startups, this high-profile investor has turned to a more traditional blue-chip name: Deere & Company (DE), also known as John Deere. On Aug. 14, Wood’s flagship ARK Innovation ETF (ARKK) made a big bet on Deere, scooping up 64,789 shares worth about $33.3 million, the largest ARK purchase in dollar value that day. And Cathie Wood wasn’t done. Over the next three consecutive trading sessions, ARK continued to add to its Deere stake, taking advantage of the stock’s selloff following the company's latest earnings report. What makes this move even more interesting is how different Deere looks compared to ARK’s usual holdings. The Industrial giant is a dominant force in the agricultural and construction equipment market, although its growth has naturally slowed in recent years as a mature, well-established firm. That said, while it’s not a fast-growing tech disruptor, Deere has been investing heavily in AI-driven automation to improve crop yields and efficiency, which appears to have drawn Wood’s interest. These latest transactions signal Wood's conviction in Deere’s long-term potential despite recent market weakness. So, with Wood taking a bullish stance on DE stock, is now the right time for investors to jump in as well? About Deere StockDeere & Company, better known by its brand name John Deere, is an iconic U.S. manufacturer of agricultural, construction, forestry, and turf equipment. Founded in 1837 by blacksmith John Deere, who invented the first commercially successful self-scouring steel plow, the company combines nearly two centuries of heritage with modern innovation. It has long been recognized for its iconic green and yellow machinery. Based in Illinois, Deere operates globally, with manufacturing plants located across the U.S., Canada, Europe, Latin America, India, South Africa, and other regions. Deere designs, builds, and supports a broad portfolio that includes tractors, combines, sprayers, forestry machinery, construction equipment, and residential lawn equipment, as well as financial services. Over recent years, Deere & Company has been reinventing itself as a technology leader, investing heavily in AI, automation, and precision agriculture to drive the future of farming. Its innovations include the autonomous 8R tractor, introduced in 2022, which operates without a driver using AI, sensors, and GPS. Meanwhile, the John Deere Operations Center enables farmers to make smarter, more informed decisions by turning data into actionable insights. Valued at about $134 billion by market capitalization, this agricultural and construction equipment maker has been a strong performer. Over the past year, the stock has soared an impressive 32%, outshining the broader S&P 500 Index’s ($SPX) 16% return during the same stretch. So far this year, DE stock is up 17%, once again sailing past the broader index, which has surged roughly 10% year-to-date (YTD).

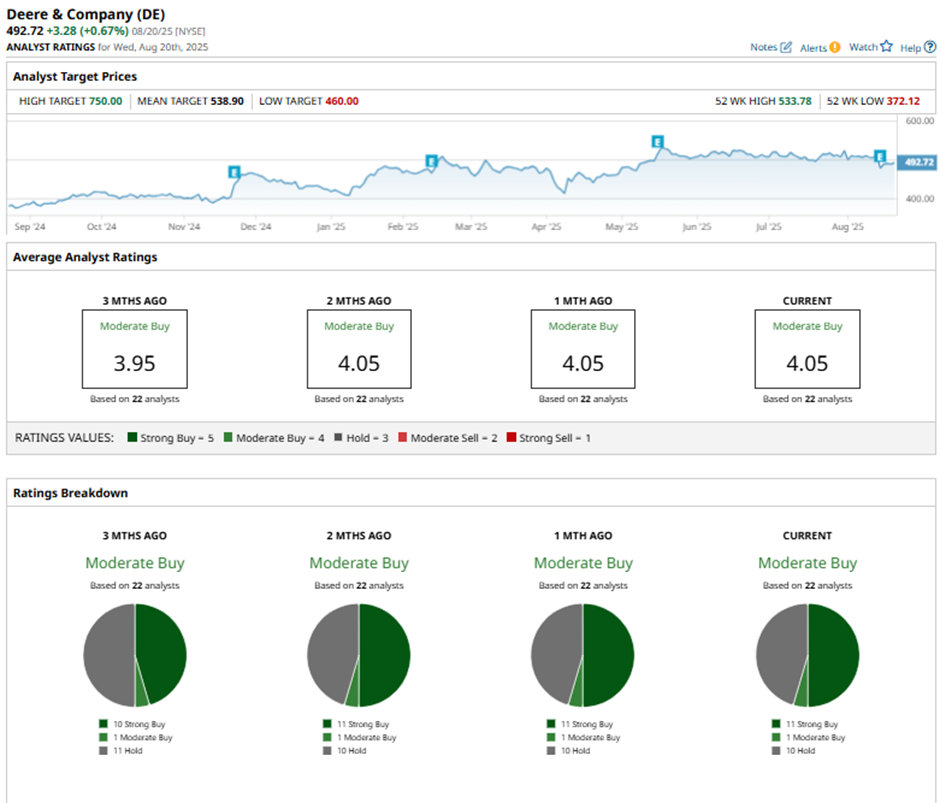

Alongside its strong share performance, Deere continues to deliver steady income to investors through its dividend payments. On Aug. 8, the company paid a quarterly dividend of $1.62 per share. The company’s forward annualized dividend of $6.48 per share translates to a modest yield of 1.28%. Why Did Deere Tumble After Q3 Earnings?Shares of Deere stock crashed almost 7% on Aug. 14 after the agricultural equipment giant posted its fiscal 2025 third-quarter results. While the numbers weren’t a total miss, the report revealed enough red flags to shake investor confidence. Worldwide net sales and revenues totaled $12.02 billion, representing a 9% decrease year-over-year (YOY). Net sales of $10.36 billion also declined 9% annually, though they managed to edge past Wall Street’s $10.26 billion estimate. On the profit side, things looked even weaker. Net income dropped a notable 26% annually to $1.3 billion, while EPS fell 24.5% to $4.75. That said, EPS still came in slightly above Wall Street’s expectations of $4.62. The cracks became even clearer when breaking down the divisions. Production and precision agriculture sales sank 16% YOY, while small agriculture and turf equipment slipped 1%. Construction and forestry sales also contracted, down 5% annually. Deere pointed to ongoing tariff headwinds and intense competition in the North American construction market as major culprits. In fact, during the company’s Q3 earnings call, Director of Investor Relations John Beal revealed that Deere absorbed around $200 million in tariff costs in the third quarter alone, bringing the YTD total to $300 million. Key pain points included higher tariff rates on Europe and India, as well as on steel and aluminum. Looking ahead, Deere now expects fiscal 2025 net income to be in the range of $4.75 billion to $5.25 billion, trimming the top end from $5.50 billion previously. Management also warned that tariff costs could reach as high as $600 million for the full year, further rattling investor confidence. What Do Analysts Think About Deere Stock?Despite the post-earnings selloff, Wall Street is not turning its back on DE stock, maintaining a consensus “Moderate Buy” rating overall. Of the 22 analysts offering recommendations, 11 advocate for a “Strong Buy,” one leans toward a “Moderate Buy,” and the remaining 10 analysts urge investors to “Hold.” The average analyst price target of $538.90 represents potential upside of 9% from current market prices. However, the Street-high target of $750 suggests an impressive 51% rally from current levels. That kind of potential is rare for a blue-chip industrial powerhouse like Deere, whose stability often limits such explosive upside projections. What makes DE stock even more compelling now is the stamp of approval from a high-profile investor like Cathie Wood, whose recent purchase of shares has brought the industrial giant into the spotlight for growth-focused investors who typically overlook traditional machinery plays. With the backing of innovation-driven money, Deere’s blend of AI-powered automation and long-term growth potential makes the stock look like a smart bet right now.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|