|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

Is Target Stock a Buy, Sell, or Hold After Appointing a New Insider CEO?

Target (TGT) stock took a sharp hit following the Aug. 20 announcement that long-time Chief Operating Officer Michael Fiddelke, who has been with the company for 20 years, will succeed Brian Cornell as CEO effective Feb. 1, 2026. Shares plunged 6.3% the day of the news. The predominantly negative investor reaction suggests investor skepticism that an internal promotion can deliver the transformational leadership needed to reverse Target’s prolonged sales slumps and operational inefficiencies. While Fiddelke has outlined a turnaround strategy centered on revitalizing merchandising, improving in-store experience, and accelerating technology deployment, analysts warn that this insider appointment may not possess the “pop” and fresh perspective of an external hire. Given a backdrop of weak comparable-store sales, declining customer sentiment, and stiff competition, should you consider TGT stock as a buy, sell or hold? About Target StockHeadquartered in Minneapolis, Minnesota, Target is a leading U.S. general merchandise retailer known for offering stylish, high-quality products at affordable prices across nearly 2,000 stores in the United States. The company’s market capitalization stands at approximately $45 billion, placing Target among the world’s leading retailers in terms of valuation. TGT stock has had a notably rough ride year-to-date (YTD), underperforming the broader benchmarks. Since the start of 2025, shares are down around 27% amid lingering negative sentiments from sluggishness in comparable-store sales, significant cost pressures from tariffs, and underperformance in digital engagement. The announcement of Fiddelke as Target's new CEO triggered another wave of selling as markets question whether an internal successor can deliver the strategic reset often associated with external hires. TGT stock is down by 37% over the past 52 weeks.

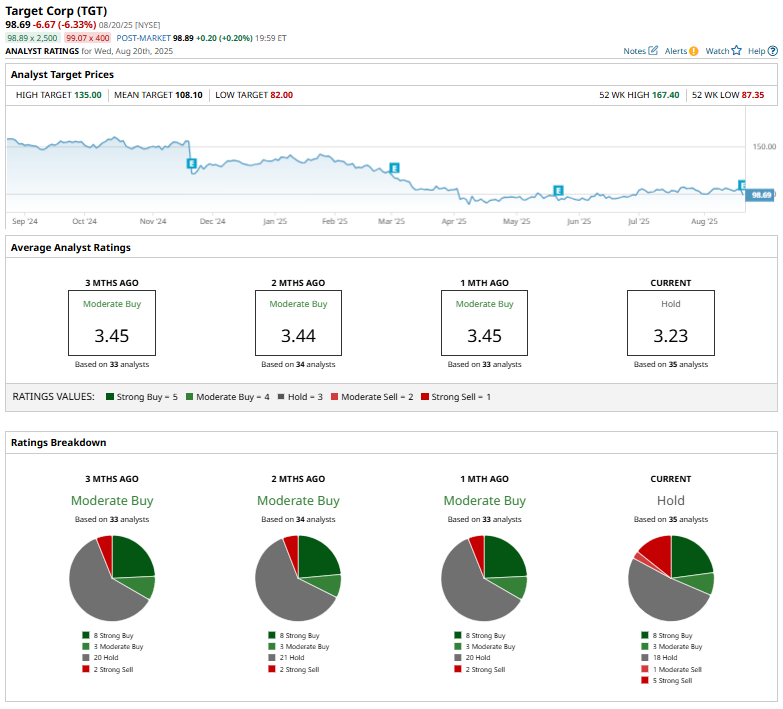

TGT currently trades at a discount compared to the sector median as well as its own historical average at 12.97 times forward earnings. Weak Q2 PerformanceTarget reported its second-quarter 2025 earnings on Aug. 20, delivering a performance that reflected both modest improvements and ongoing pressures. The company posted net sales of $25.2 billion, marking a marginal year-over-year (YOY) decline, although this represented nearly a two-percentage-point improvement sequentially. Comparable sales fell 1.9%, with comparable store sales down 3.2% while comparable digital sales rose 4.3%, buoyed by same-day delivery growth exceeding 25%, along with strength in services like Drive Up and Target Circle 360. In terms of profitability, adjusted EPS came in at $2.05, below the year-ago quarter value of $2.57. However, strong expense management and efficiency gains were offset by considerable margin pressure. Operating income dropped 19.4% YOY to $1.3 billion, and the operating income margin compressed to 5.2% from 6.4% a year earlier. Similarly, gross margin narrowed from 30% to 29%. Target reaffirmed its full-year fiscal 2025 guidance, further expecting a low-single-digit decline in sales, and adjusted EPS of approximately $7 to $9. Analysts predict EPS to be around $7.48 for the current fiscal year, down 15.6% YOY, before surging by 8.8% annually to $8.14 in the next fiscal year. What Do Analysts Expect for Target Stock?In recent weeks, Wall Street sentiment toward Target has tilted notably cautious, marked by multiple downgrades. On Aug. 20, Truist lowered its price target on Target from $107 to $102 while maintaining a “Hold” rating, citing concerns over the recent promotion of insider Michael Fiddelke to CEO. Truist questioned Fiddelke’s ability to drive necessary strategic changes, noting that Target has “lost competitive relevance” during his tenure. While near-term margin improvement is expected from cleaner inventories and reduced shrink, Truist remains cautious about the company’s long-term earnings potential due to the significant investments still required. Meanwhile, Jefferies cut its price target on Target from $120 to $115 but kept a “Buy” rating, noting the soft comparable sales and tariff-related pressures for the trim, though it pointed to digital growth, alternative revenue streams, cost discipline, and improved shrink that should be key drivers of margin gains. On the other hand, Bank of America’s Robert Ohmes downgraded the stock on Aug. 15, from “Neutral” to “Underperform,” slashing the price target from $105 to $93, a reflection of concerns over sluggish digital sales, tariff exposure, and competitive pressures in advertising and marketplace operations. TGT stock has a consensus “Hold” rating overall. Out of 35 analysts covering the retail stock, eight recommend a “Strong Buy,” three analysts suggest a “Moderate Buy,” 19 analysts stay cautious with a “Hold” rating, one has a “Moderate Sell” rating, and four give a “Strong Sell.” The average analyst price target for TGT is $107.87, indicating a potential upside of 8.7% from here. Meanwhile, the Street-high target price of $135 suggests that the stock could rally 36% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|