|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

Do Wall Street Analysts Like MSCI Stock?/MSCI%20Inc%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $44.5 billion, MSCI Inc. (MSCI) is a global provider of investment decision support tools and services, offering indexes, analytics, ESG and climate solutions, and portfolio risk management tools to institutional investors. Headquartered in New York, the company serves asset managers, banks, hedge funds, and pension funds worldwide. Shares of MSCI have outperformed the broader market over the past 52 weeks. MSCI has soared 1.8% over this period, while the broader S&P 500 Index ($SPX) has gained 16.1%. However, shares of MSCI are down 4.2% on a YTD basis, underperforming SPX’s 10% rise during the same time frame. Looking closer, MSCI has lagged behind the Financial Select Sector SPDR ETF Fund’s (XLF) 21.6% surge over the past 52 weeks and 10.8% return on a YTD basis.

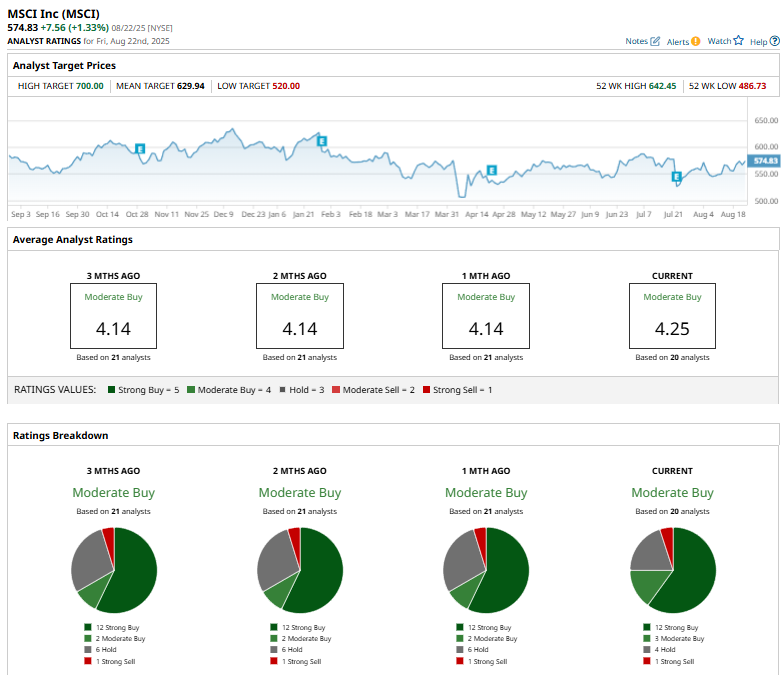

On Jul. 22, MSCI reported solid Q2 2025 results, with revenue rising nearly 9% to $772.7 million and adjusted EPS up about 15% to $4.17, surpassing analyst estimates. Despite the beat, shares slipped around 8.9% as investors reacted to slower net new subscriptions and ESG-related growth challenges. For the fiscal year ending in December 2025, analysts expect MSCI’s adjusted EPS to increase 12.3% year-over-year to $17.07. The company's earnings surprise history is strong. It beat the consensus estimates in the past four quarters. Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, three “Moderate Buys,” four “Holds,” and one “Strong Sell.”

On July 23, Wells Fargo analyst Jason Haas maintained an “Equal-Weight” rating on MSCI while lowering the price target from $578 to $533. MSCI’s mean price target of $629.94 implies a premium of 9.6% from the prevailing market prices. The Street-high price target of $700 implies a potential upside of 21.8% from the current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|