|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

Westinghouse Air Brake Stock: Is Wall Street Bullish or Bearish?/Westinghouse%20Air%20Brake%20Technologies%20Corp%20logo%20and%20website-by%20Wirestock%20Creators%20via%20Shutterstock.jpg)

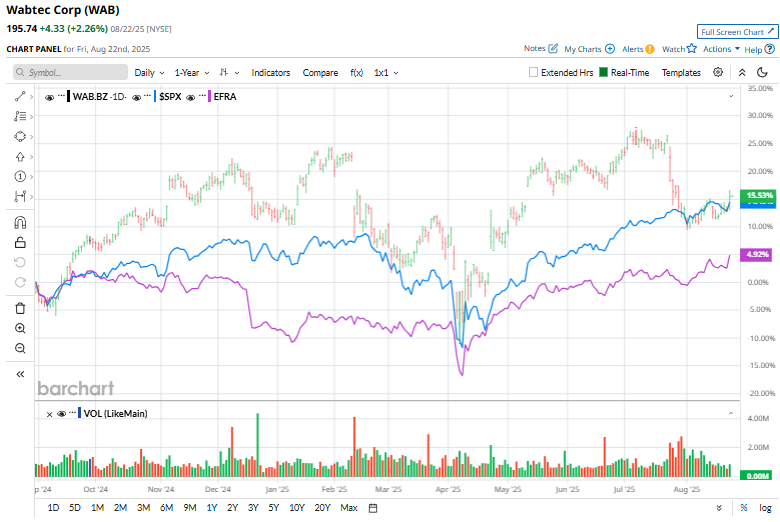

Headquartered in Pittsburgh, Pennsylvania, Westinghouse Air Brake Technologies Corporation (WAB) is a global leader in technology-driven locomotives, equipment, systems, and services for the freight rail and passenger transit industries. With a market cap of $33.5 billion, the company operates through two primary segments: Freight and Transit. WAB’s stock prices have grown 19.9% over the past 52 weeks, surpassing the S&P 500 Index’s ($SPX) 16.1% gains over the past year. However, on a YTD basis, WAB has surged 3.2%, trailing the $SPX’s 10% rise in 2025. Narrowing the focus, WAB has also outperformed the iShares Environmental Infrastructure and Industrials ETF’s (EFRA) 7.6% rise over the past 52 weeks but has lagged the ETF’s 14.4% rise on a YTD basis.

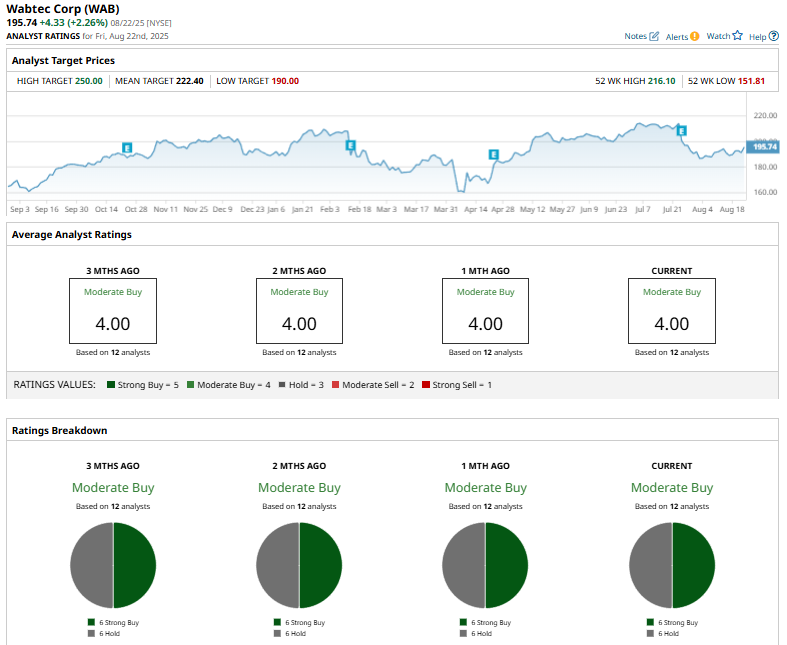

On Jul. 24, Westinghouse Air Brake Technologies reported second-quarter results, and its shares dipped 6.4%. It posted an adjusted EPS of $2.27, up 15.8% year-over-year and ahead of estimates, while revenue rose 2.3% to $2.71 billion but fell slightly short of forecasts. Net income climbed 16% to $336 million, supported by strong margin performance, and the backlog grew nearly 12% to $8.2 billion, signaling healthy future demand. For the current fiscal year, ending in December, analysts expect WAB to report an impressive 17.6% year-over-year increase in adjusted EPS to $8.89. The company has a mixed earnings surprise history. It has surpassed the Street’s bottom-line estimates in three of the past four quarters, while missing on one occasion. WAB has a consensus “Moderate Buy” rating overall. Of the 12 analysts covering the stock, opinions include six “Strong Buys” and six “Holds.”

This configuration has remained mostly stable in recent months. On August 14, JPMorgan analyst Tami Zakaria reiterated a “Neutral” rating on Westinghouse Air Brake but lowered the price target from $216 to $200, reflecting a 7.41% reduction in the expected stock price. WAB’s mean price target of $222.40 indicates a modest premium of 13.6% from the current market prices. Moreover, the Street-high target of $250 suggests a notable 27.7% upside potential. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|