|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

Should You Buy the Post-Earnings Plunge in Canadian Solar Stock?/Solar%20panels%20on%20sunny%20day%20by%20andreas160578%20via%20Pixabay.jpg)

Renewables have once again come into the spotlight after U.S. President Donald Trump said his administration will not approve solar or wind power projects. Although demand for electricity is growing faster than supply in some parts of the country, the administration appears adamant about sticking with conventional energy sources. Trump’s words follow the administration's tightening of federal permitting for renewables. Against such a backdrop rife with tension, solar energy company Canadian Solar (CSIQ) reported its second-quarter results on Aug. 21, which immediately led to CSIQ stock dropping more than 18% intraday. Should you consider investing in the company’s post-earnings plunge? About Canadian Solar StockCanadian Solar, headquartered in Ontario, Canada, is a leading global provider of solar energy solutions and one of the world’s largest manufacturers of solar photovoltaic (PV) products. Founded in 2001, the company designs, develops, and manufactures solar modules, as well as provides solar energy and battery storage solutions. Canadian Solar operates advanced manufacturing plants in several countries. Beyond manufacturing, the company is actively engaged in the development and construction of large-scale solar and battery storage projects. The company currently has a market capitalization of $741 million. CSIQ stock has been downtrodden for quite some time now. Over the past 52 weeks, shares have dropped 10%. CSIQ is also down by 0.45% year-to-date (YTD). After reporting weak Q2 earnings and President Trump’s announcement, CSIQ stock fell 18.5% intraday on Aug. 21. Canadian Solar last reached a 52-week high of $19.55 in October 2024, but shares are down more than 43% from that high.

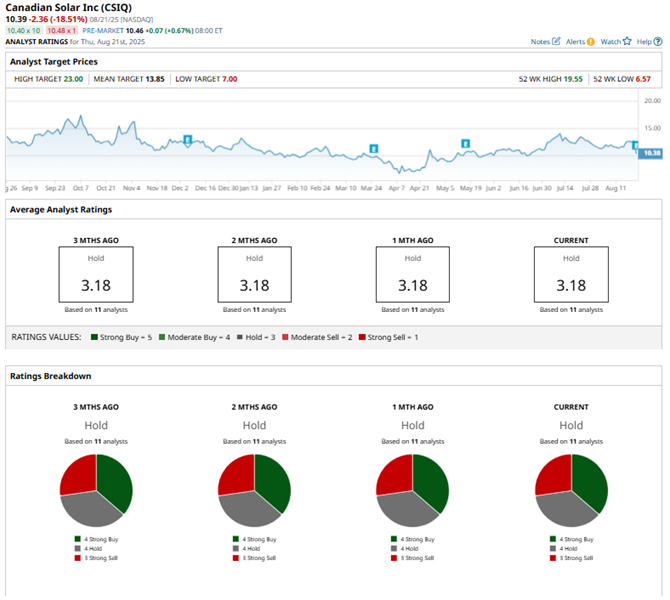

CSIQ stock currently sits at an attractive valuation. Its price is 0.12 times sales, which is significantly lower than the industry average. Canadian Solar’s Q2 Results Missed Analyst ExpectationsOn Aug. 21, Canadian Solar reported its second-quarter results for fiscal 2025. Total net revenues increased 3.6% from the prior year’s period to $1.69 billion. However, this figure fell short of Wall Street analysts’ consensus estimate of $1.92 billion. At the heart of this modest revenue growth was the company's increased sales of battery energy storage systems and solar modules, while storage systems shifted to the second half of the year, along with delays in certain project sales. On the other hand, gross margin increased from 17.2% in Q2 2024 to 29.8% in Q2 2025, driven by a higher mix of North America module shipments and solid storage volumes. The company’s adjusted bottom-line nosedived compared to the prior year’s period. Its adjusted loss per share stood at $0.53 for the quarter, while Canadian Solar had reported an adjusted EPS of $0.02 in the same period last year. Wall Street analysts were expecting earnings of $0.76 per share. For the third quarter, the company expects total revenue to be in the range of $1.3 billion to $1.5 billion. Gross margin is expected to be 14% to 16%. For the full year of 2025, Canadian Solar expects total revenue to be in the range of $5.6 billion to $6.3 billion, down from the previous range of $6.1 billion to $7.1 billion. Wall Street analysts have mixed expectations about Canadian Solar’s bottom-line prospects. For the current year, the company’s loss per share is expected to widen by 20% from the prior year to $1.74. On the other hand, in the next year, loss per share is expected to narrow 44% YOY to $0.97. What Do Analysts Think About Canadian Solar Stock?Wall Street analysts have become cautious about CSIQ stock post its Q2 results. Recently, analysts at Citi lowered the price target on the company’s stock from $12.50 to $11, while maintaining a “Neutral” rating. Citi cut the price target after the company missed estimates and cut its financial guidance for fiscal 2025. Analysts at the firm also expressed concern over Canadian Solar maintaining its FEOC compliance. Mizuho analyst Maheep Mandloi also lowered the price target on Canadian Solar from $17 to $15. However, Mandloi kept the “Outperform” rating on the shares, expressing the view that the company’s Q2 results were mixed due to a confluence of factors. Wall Street analysts are cautious about CSIQ stock, giving it a consensus “Hold” rating overall. Of the 11 analysts rating the stock, four give it a “Strong Buy” rating, three are cautious with a “Hold” rating, and four advise a “Strong Sell” rating. The consensus price target of $13.50 represents 22% potential upside from current levels. The Street-high price target of $23 implies 107% potential upside from here.

Key TakeawaysDespite clean energy initiatives gaining traction, Trump’s recent words highlight the fact that support for renewables may be pulled back. Furthermore, Canadian Solar’s Q2 results missed estimates, and the company's reduction of its outlook creates further uncertainty. Therefore, it might be prudent to watch CSIQ stock for now. On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|