|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

KLA Corporation Stock: Analyst Estimates & Ratings/KLA%20Corp_%20website%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

KLA Corporation (KLAC), headquartered in Milpitas, California, is a $114.8 billion global leader in designing, manufacturing, and marketing process control, yield management, and process-enabling solutions for the semiconductor and electronics industries. The company operates through three key segments: Semiconductor Process Control, Specialty Semiconductor Process, and PCB and Component Inspection. Shares of KLAC have underperformed the broader market over the past 52 weeks. KLAC stock has increased 9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.2%. However, shares of KLAC are up 38.1% on a YTD basis, outpacing $SPX’s 10% rise. In addition, KLAC has outpaced Invesco Semiconductors ETF’s (PSI) 10.1% decline over the past 52 weeks and 8.1% fall in 2025.

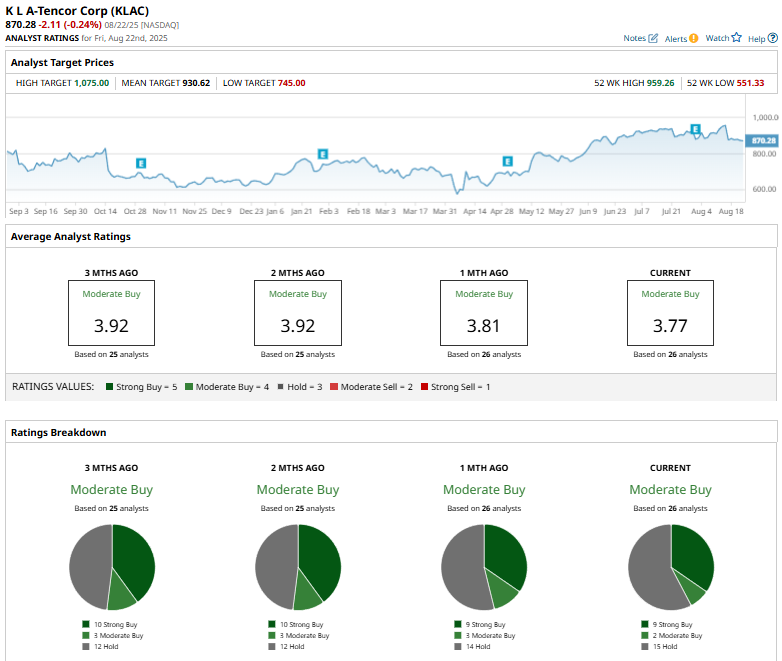

On Jul. 31, KLAC shares dipped 5% after the company released its fourth-quarter earnings. Its revenue rose 24% year-over-year to $3.18 billion and non-GAAP EPS of $9.38, exceeding expectations and guidance. Growth was driven by a 52% surge in wafer inspection sales and a 25% increase in semiconductor process control revenue, supported by AI-driven demand. For the fiscal year ending in June 2026, analysts expect KLAC's EPS to rise 3.3% year-over-year to $34.37. The company's earnings surprise history is impressive. It beat the consensus estimates in each of the last four quarters. Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, two “Moderate Buys,” and 15 “Holds.”

The current consensus is bearish than two months ago, when it had 10 “Strong Buy” suggestions. On Aug. 2, Citigroup Inc. (C) analyst Atif Malik reiterated a “Buy” rating on KLAC, raising the price target to $1,060 from $1,035. KLAC’s mean price target of $930.62 indicates a premium of 6.9% from the current market prices. While the Street-high target of $1,075 suggests a robust 23.5% upside potential. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|